Managing debt is a critical aspect of financial health, whether you’re an individual or a business. Poor debt management can lead to financial stress, affect credit scores, and limit future financial opportunities. Here are five effective strategies to manage debt, including the importance of mitigating financial risks with a robust risk management plan.

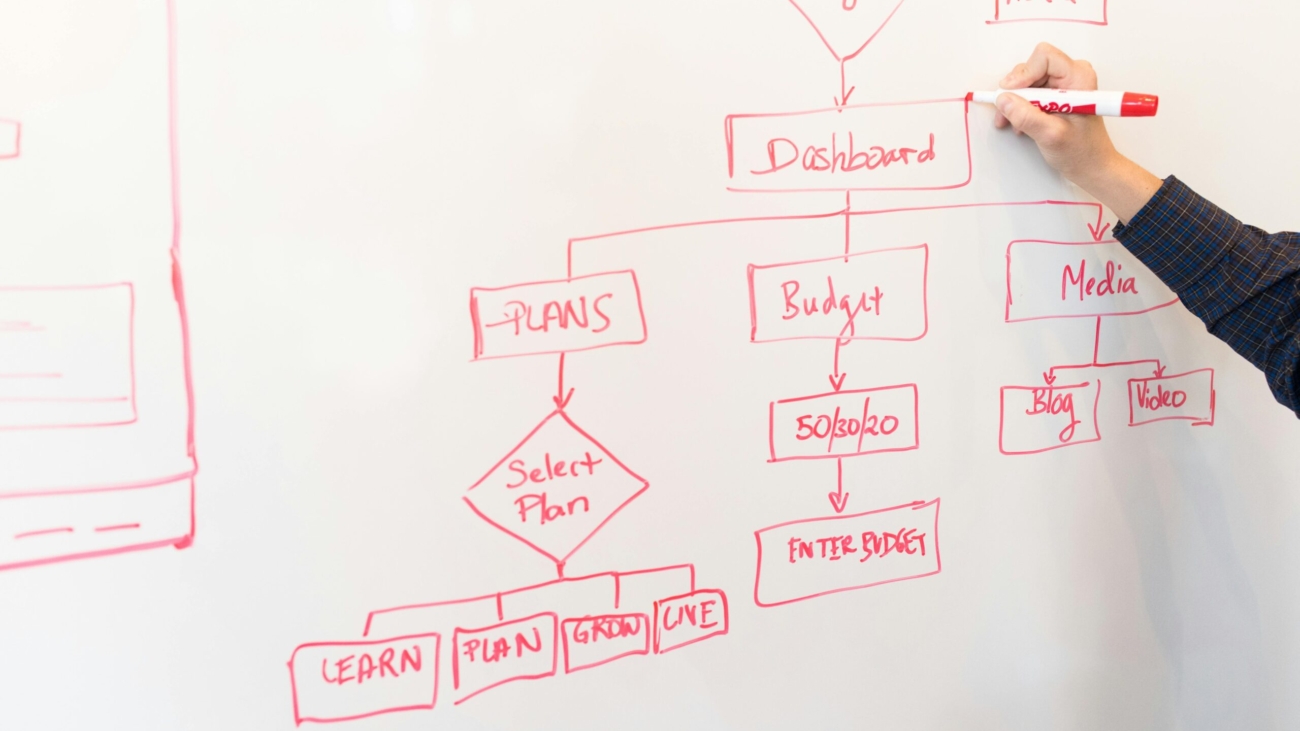

1. Create a Detailed Budget

The first step in managing debt effectively is to create a comprehensive budget. A budget helps you understand your income, expenses, and how much you can allocate towards debt repayment each month. Here’s how to create a detailed budget:

- List all income sources: Include your salary, bonuses, investment income, and any other sources of revenue.

- Track all expenses: Categorize your expenses into fixed (rent, utilities) and variable (groceries, entertainment).

- Identify areas to cut back: Look for non-essential expenses that can be reduced or eliminated.

- Allocate funds for debt repayment: Prioritize your debt payments within your budget.

By sticking to a well-planned budget, you can ensure that you have enough funds to pay off your debts regularly and avoid unnecessary expenses.

2. Prioritize High-Interest Debt

Not all debts are created equal. Some debts, like credit card debt, carry higher interest rates than others, such as student loans or mortgages. To manage debt effectively, prioritize paying off high-interest debts first. This approach, known as the avalanche method, can save you money on interest over time. Here’s how it works:

- List your debts: Organize your debts by interest rate, from highest to lowest.

- Focus on the highest interest debt: Make larger payments towards the debt with the highest interest rate while making minimum payments on other debts.

- Move to the next debt: Once the highest interest debt is paid off, redirect your payments to the next highest interest debt.

This strategy reduces the total interest paid and accelerates your journey to becoming debt-free.

3. Consolidate Your Debts

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This strategy can simplify your debt repayment process and reduce the amount of interest you pay. There are several ways to consolidate debt:

- Personal loans: Use a personal loan to pay off high-interest credit card debts.

- Balance transfer credit cards: Transfer high-interest credit card balances to a card with a lower interest rate.

- Home equity loans: Use the equity in your home to consolidate debts at a lower interest rate.

Debt consolidation can make it easier to manage your debts by reducing the number of payments you need to make each month and potentially lowering your overall interest costs.

4. Implement a Debt Repayment Plan

A structured debt repayment plan can help you stay organized and committed to paying off your debts. Two popular methods are the snowball method and the avalanche method:

- Snowball method: Focus on paying off the smallest debt first while making minimum payments on larger debts. Once the smallest debt is paid off, move to the next smallest, and so on. This method provides quick wins that can boost your motivation.

- Avalanche method: Focus on paying off the debt with the highest interest rate first, as mentioned earlier. This method can save you more money on interest in the long run.

Choose the method that aligns best with your financial situation and personal preferences.

5. Mitigate Financial Risks with a Risk Management Plan

An often-overlooked aspect of debt management is mitigating financial risks through a risk management plan. This plan involves identifying potential financial risks and developing strategies to manage them. Here’s how to create a risk management plan:

- Identify risks: Assess potential risks, such as job loss, medical emergencies, or economic downturns, that could affect your ability to repay debts.

- Develop contingency plans: Create strategies to address these risks, such as building an emergency fund, obtaining insurance, or having a backup income source.

- Review and adjust regularly: Regularly review your risk management plan and make adjustments as needed based on changes in your financial situation or the economic environment.

A robust risk management plan can provide a safety net, ensuring that you can continue to meet your debt obligations even in the face of unexpected financial challenges.

Effective debt management requires a combination of budgeting, prioritizing high-interest debt, consolidating debts, implementing a structured repayment plan, and mitigating financial risks with a risk management plan. By adopting these strategies, you can take control of your debt, reduce financial stress, and work towards achieving long-term financial stability.